- October 6, 2020

- Uncategorized

- No Comments

How to choose the right hybrid mutual fund

As I write this article, Nifty is back at 11,500 levels, a 42% jump from 8083 levels seen in April this year. While we still haven’t seen the 12,300 levels seen at the beginning of this calendar year, there has been more than a significant pullback on the markets. Gold has rallied and so have the debt markets.

I know quite a few of us panicked and took out money near bottom and never got back to riding the wave. To add to the confusion the economy and the markets seem to be working in opposite directions. Do hybrid/multi- asset strategies of mutual funds make sense at this point in time? What are hybrid and multi-asset strategies? How do they work? Let us analyze.

If we get into categorizations as defined by Sebi, then there are six funds that fall under this category – Conservative Hybrid Funds, Balanced Hybrid Funds, Aggressive Hybrid Funds, Dynamic Asset Allocation or Balanced Advantage Funds , Equity Savings Funds, Multi Asset Allocation Funds and Arbitrage Funds. Multi Asset Allocation Funds have to have at least three asset classes. The others are mostly a combination of debt and equity/equity related instruments. Cash, of-course, continues to be a part of all portfolios and I am not counting this as a separate asset class.

Let us start with hybrid strategies that invest in only two asset classes – debt and equity. Hybrid conservative debt funds are what one might call the erstwhile Monthly Income Plans (MIPs). Equity and equity-related instruments have to be between 10% to 25% of total assets in conservative funds. As the name suggests, it is for a conservative equity investor.

Next in line are hybrid balanced funds. They have to have equity/equity related instruments between 40%-60%, the balance being in debt. One can barely find 10-15 funds here and most seem to be dedicated to specific purposes as retirement or for children. Perhaps the reason for its near-death are dynamic asset allocation funds and equity savings funds. In equity savings funds, the minimum investment in equity and equity related instruments is 65%. Does that mean they are more aggressive than hybrid balanced funds? The answer is no. Unlike hybrid balanced funds, equity savings funds are allowed to have an arbitrage component. We know practically arbitrage is a near substitute to debt and does not bear the extreme volatility or risk as experienced in equity. However, it is technically an equity related instrument.

We come next to dynamic asset allocation funds. If you want to take a balanced approach but are unsure about what percentage of equity and debt you would like to maintain, you might want to pick a dynamic asset allocation fund. Sebi does not define any minimum or maximum equity/ debt percentage in this category, and it is at the discretion of the fund management.

Why I say fund management and not fund manager is because most funds here are run on price to earnings (P/E) or price-to book (P/B) models. These ratios inherently tell you how ‘expensive’ the market is and therefore what component of equity should be maintained in the portfolio. There can be an inherent disadvantage when you work on these ratios. They are unable to catch a trend as the model continuously tells you that the markets are expensive and to be under allocated in equity. To overcome this limitation, a few fund houses have built in valuation-based models. While most funds do have arbitrage as a component of their equity related dispensation, those as HDFC have chosen not to do so. The ones who chose not to have an arbitrage play tend to be as risky as aggressive hybrid funds.

Next on the aggression scale, according to me, are aggressive hybrid funds. As per Sebi norms, they are to have a minimum of 65% into equity and equity related funds and this can stretch up to 80%. While Sebi is silent on the use of arbitrage in these funds, practically not many funds have a heavy component of arbitrage here.

Another category of funds that are making a lot of noise nowadays is multi-asset allocation funds. Sebi defines these funds as those that invest in at least three asset classes, with each asset class having a minimum of at least 10% of overall allocation. Here while most fund houses have invested in commodities (essentially gold) as a third asset class, some have also picked up real estate and international equities. In this category depending upon the orientation towards equity, the fund can be taxed either as an equity fund or a debt fund.

I don’t really see arbitrage funds as investment-oriented funds. One would probably use them for interim parking or at best for a very conservative customer. While technically they fall under hybrid funds, in practice, they aren’t and in spirit should not form a part of this discussion.

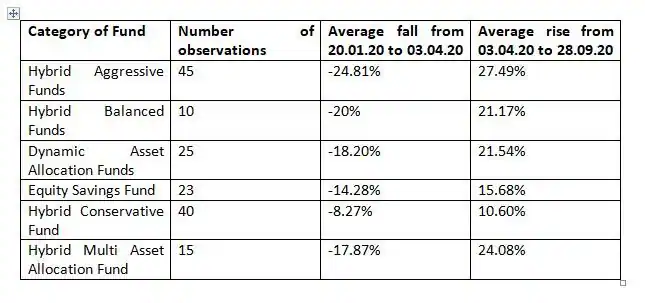

Now let’s look at some numbers to see the returns and the variability in returns in these funds.

We haven’t gone too far back in history. we divided performance of funds in two parts. The fall from 20th January to 3rd April and the rise from 03rd April to 28th September of this year. During this time period, Nifty fell by 34.97% and then rose by 38.86%.